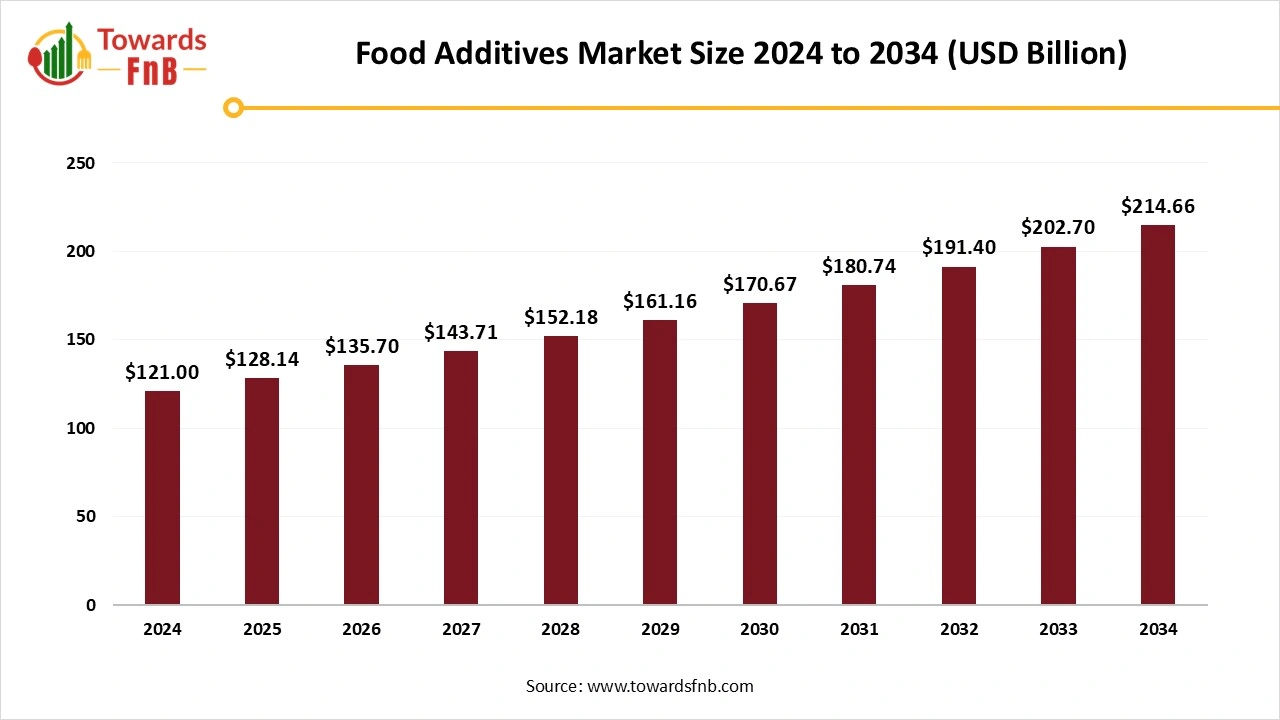

Food Additives Market Set to Grow USD 214.66 Billion by 2034, Driven by Consumer Demand for Healthier and Sustainable Products

According to Towards FnB, the global food additives market size is calculated at USD 128.14 billion in 2025 and is projected to hit USD 214.66 billion by 2034, representing a CAGR of 5.9% from 2025 to 2034. This growth is driven by increasing demand for processed foods, enhanced food safety, and innovations in natural and plant-based additives.

Ottawa, Oct. 10, 2025 (GLOBE NEWSWIRE) -- The global food additives market size was valued at USD 121 billion in 2024 and is predicted to increase from USD 128.14 billion in 2025 to reach nearly USD 214.66 billion by 2034, expanding at a CAGR of 5.9% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market is experiencing growth due to high demand for food enhancers, processed foods, food colorants, and improved food quality and safety. The use of additives also helps make the food more attractive, further fueling the market's growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5494

Key Highlights of the Food Additives Market

- By region, the Asia Pacific led the food additives market in 2024, whereas North America is expected to grow in the foreseeable period.

- By type, the dietary fibers segment led the food additives market in 2024, whereas the colors segment is expected to grow in the foreseeable period.

- By source, the natural segment led the food additives market in 2024, whereas the synthetic additives segment is expected to grow in the foreseeable period.

- By form, the dry segment led the food additives market in 2024, whereas the liquid segment is expected to grow in the foreseeable period.

- By application, the food segment led the food additives market in 2024, whereas the liquid segment is expected to grow in the foreseeable period.

- By functionality, the thickening segment led the food additives market in 2024, whereas the stabilizing segment is expected to grow in the foreseeable period.

Enhanced Food Quality and Safety Fueling Demand for Food Additives

The food additives market is observing growth lately due to high demand for convenient, ready-to-eat, and processed food options. Consumers prefer such options with hectic lifestyles. Hence, to enhance the flavors, textures, and appearance of such food items, food additives play a major role, further enhancing the growth of the food additives market. Additives also help to enhance the freshness, nutritional properties, and shelf life of food items, making them ideal for global transportation without any wastage. To maintain the quality of packaged foods, food additives play a major role, further fueling the growth of the market.

Impact of AI in the Food Additives Market

AI is becoming an influential force in the food additives market, enabling smarter ingredient discovery, safer formulations, dynamic quality control, and regulatory agility. In R&D, AI and machine learning models help simulate molecular interactions among additives, food matrices, and processing conditions, allowing developers to predict how a new preservative, flavor, colorant, or texturizer will behave before running costly lab experiments. Tools like “TastePepAI” already aim to generate novel taste peptides, with built-in safety checks, for use as natural flavor enhancers in future formulations. AI also supports safety assessment: predictive toxicology models, QSAR techniques, and risk evaluation algorithms help companies screen additives for potential hazards or regulatory risks, shortening the path to compliance. On the manufacturing side, AI systems monitor production lines, detect deviations in additive blending, concentration, or impurity levels in real time, and trigger corrective actions to maintain quality consistency.

For instance, AI models are already being employed by major food manufacturers like Nestlé to predict the behavior of additives in different formulations, reducing the time needed for R&D by up to 30%. AI is also crucial in ensuring safety and compliance, especially in regulatory-heavy regions such as the European Union.

New Trends in the Food Additives Market

- The high demand for natural and plant-based food additives, driven by the need to maintain sustainability, is a major factor in the market's growth. Such options are in high demand among consumers seeking clean-label products, organic items, and functional food choices.

- High demand for convenient and ready-to-eat food options is another major factor for the growth of the market. Food additives help to maintain the flavor, texture, and quality of such food options.

- Incorporating functional additives such as probiotics, omega-3, and antioxidants to enhance overall health and strengthen immunity is also helpful for the growth of the food additives market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-additives-market

Recent Developments in Food Additives Market

- In April 2025, the U.S. Department of Health and Human Services and the Food and Drug Administration announced that they would cease using petroleum-based food dyes in the American food supply, with the initiative to make the country healthier and food options safer. (Source- https://www.fda.gov)

- In August 2025, San-Ei Gen F.F.I., manufacturer of food additives, announced the launch of its two new food coloring products, San-Ei Blue (R) G-BF30 WSP and San-Ei Blue (R) G-BFA20 WSP, designed for a wide range of applications, including sports drinks, flavoured waters, fruit juice beverages, tea drinks, and both hard and soft candies. The manufacturer also received approval for its Gardenia (genipin) blue by the US Food and Drug Administration (FDA). (Source- https://www.foodbev.com)

Food Additives and Their Use

| FOOD ADDITIVES | USAGE |

| Preservatives | Antimicrobial, Antibrowning, Antioxidant |

| Nutritional Supplements | Vitamins and Minerals |

| Flavoring Agents | Sweeteners, Flavor Enhancers, and Other Flavors |

| Colorings | Carotenoids, Green Dyes, Blue Dyes, etc |

| Texturing Agents | Stabilizers and Emulsifiers |

| Miscellaneous | Enzymes, Catalysers, Solvents, Propellants |

(Source- https://www.researchgate.net)

The table above depicts the usage of different types of food additives useful for different purposes. They are used to enhance the flavor, color, texture, and aesthetics of food and beverages, making them essential for the food and beverage industry. They are also helpful in enhancing the shelf life of food products, allowing for global transportation without compromising quality, which further boosts the growth of the food additives market.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5494

Food Additives Market Dynamics

What Are the Growth Drivers of the Food Additives Market?

High demand for convenient, ready-to-eat, and ready-to-prepare food options is one of the major growth drivers of the food additives market. Hectic lifestyles of consumers today fuel the demand for convenient food options, further enhancing the demand for food additives. Food additives help to enhance the flavor, texture, aesthetics, and shelf life of food and beverage items. Hence, it also helps to fuel the growth of the market. Food additives made from natural ingredients are in high demand among consumers seeking organic and clean-label products. Hence, such factors also help the growth of the food additives market.

Challenge

How Are Rising Concerns About the Use of Food Additives Hampering Market Growth?

Studies indicate that the high usage of artificial colorings, benzoate preservatives, non-caloric sweeteners, and emulsifiers, along with their breakdown products, may negatively impact health in various ways. Such additives may hamper mental health and cardiovascular health, hyperactivity disorder, and possibly carcinogenic effects as well. Hence, such issues hamper the growth of the food additives market.

Opportunity

How Is Innovation in Food Technology Driving Market Growth?

Nutritional additives help maintain the nutritional qualities of food that might be lost during the manufacturing process. Such additives help enhance food quality and address dietary deficiencies in food items. The use of metallic nanoparticles, known for their antimicrobial properties, and advanced technologies like nanoencapsulation further fuel the growth of the food additives market.

Trade Analysis of Food Additives Market: Import and Export Statistics

The global food additives sector has seen significant growth in the last few years, which is driven by higher packaged food consumption, demand for functional ingredients, and reformulation toward clean label and vegan additives. Some trade-data platforms also track shipment counts of additive products internationally.

Top Exporters in the Food Additives Market:

- The United States was one of the top exporters of food additives from November 2023 to October 2024, with U.S. suppliers accounting for about 26% of global food-additive exports.

- Germany is also a top exporter in global food additive sector due to its advanced food-processing industry, strong research and development, and manufacturing base for functional and natural additives, and efficient export infrastructure that positions it as a key ingredient hub in Europe.

Top importers in the Food Additives Market:

- Russia was the largest importer of food additives (by shipments) from November 2023 to October 2024 because its domestic food industry relies heavily on imported ingredients due to limited local additive production. Sanctions and supply-chain shifts after 2022 forced Russia to diversify imports from Asia and the Middle East, boosting shipment volumes across many small consignments rather than large bulk orders.

- Vietnam is another significant importer of additives because its rapidly expanding food processing and packaged food sector demands quality ingredients and functional additives. The country’s recent regulatory updates (e.g. Circular 17/2023) have broadened the list of permissible additives and clarified import rules, enabling more foreign additive suppliers to access the Vietnamese market.

Country / Regional Highlights and Trade Flows

-

Vietnam to Netherlands / EU connection

Bilateral trade between Vietnam and the Netherlands surged in 2024, reaching about USD 13.8 billion, with imports from the Netherlands to Vietnam worth USD 7.4 billion and USD 784 million respectively.)

- The Netherlands acts as a European hub in many trade flows, and Vietnam’s exports to EU, which includes ingredient and food product sectors, are growing.

-

Netherlands as import / export hub

Broad trade statistics show the Netherlands importing large volumes from various partners, including Vietnam. Netherlands imports from Vietnam in 2024 were valued at USD 9.53 billion.

-

U.S. importers and concentration

Among U.S. food additive importers, BENEO Inc. is one of the leading importers as per recent data, accounting for a significant share of shipments.

Trade Implications and Considerations

- Exporters increasingly need to comply with additive regulatory safety rules (e.g. JECFA/GRAS or equivalent) when entering foreign markets.

- Natural or clean-label additives are a growth hub, influencing both sourcing and regulatory demands.

- Hubs such as the Netherlands remain strategically important for routing, warehousing, and re-export within the EU or adjacent markets.

Food Additives Market Regional Analysis

Why Did the Asia Pacific Region Lead the Food Additives Market in 2024?

Rising disposable income, high demand for convenient food options, and the demand for quality foods are some of the major factors driving the growth of the food additives market in the Asia Pacific in 2024. The supportive schemes by the regional government to enhance the standard of the food and beverage industry, enabling it to compete with international standards, further fuel the growth of the food additives market. Such food additives are also helpful to enhance the texture, flavor, and shelf life of food options, which further supports the market’s growth. Countries like India and China play a major role in the growth of the market in the region.

Why Is North America Expected to Be the Fastest-Growing Region During the Forecast Period?

North America is expected to grow in the foreseen period due to the high demand for convenient, frozen, and ready-to-eat food options, driven by the hectic lifestyles of consumers in the region. Functional and technological advantages beneficial to the food additives industry will further fuel market growth in the foreseeable period. Additives help to enhance the taste, texture, quality, and appearance of food items in a safe, sustainable, and cost-effective manner. Hence, such factors also aid the growth of the market.

Food Additives Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.9% |

| Market Size in 2025 | USD 128.14 Billion |

| Market Size in 2026 | USD 135.70 Billion |

| Market Size by 2034 | USD 214.66 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food Additives Market Segmental Analysis

Type Analysis

The dietary fibers segment led the food additives market in 2024 due to high demand for food items such as breads and tortillas. Such food items contain high fiber content, such as cellulose, which absorbs less water. Hence, such food options are also recommended to consumers facing digestive issues such as indigestion and IBS. Hence, such factors also fuel the growth of the market.

The colors segment is expected to grow in the foreseen period, as enhancing the food's appearance helps brands improve their image. Food colorants help the food and beverage industry enhance its demand and remain strong in the competition. Hence, the segment is observed to grow in the foreseen period. Different types of food colorants, including synthetic colors and those derived from natural sources like fruits, vegetables, and spices, further fuel the growth of the market.

Source Analysis

The natural segment dominated the food additives market in 2024 due to rising health awareness among consumers. Natural food additives enhance food texture, quality, taste, and appearance, further fueling the growth of the food additives market. Hence, the segment has a major contribution to the growth of the market. Today, consumers scan the labels of food items to get complete knowledge about the additives used. Hence, natural additives are in high demand among consumers, further fueling the growth of the market.

The synthetic additives segment is expected to grow in the foreseen period, as the procedure of manufacturing synthetic additives is sustainable and safe for consumption as well. The procedure requires fewer resources to double the quantity, which further aids the growth of the market. The process also involves the use of safe, dependable, and synthetic organic fragrances, further enhancing the growth of the market.

Form Analysis

The dry segment led the food additives market in 2024, as dry additives are easy, safe, and convenient to handle. They are also easy to use and help to enhance the shelf life of products, further fueling the growth of the market. Handling of dry additives is cost-effective compared to handling of liquid additives. Hence, the segment has a major contribution to the growth of the food additives market.

The liquid segment is observed to grow in the foreseen period, as it can be easily blended into liquid and semi-liquid food options. Liquid additives are in high demand for the preparation of marinades, sauces, beverages, and various other forms of liquids. Hence, the segment has a major role in the growth of the food additives market in the foreseeable period. The form enhances the flavor of liquid beverages and aids in the formation of novel food combinations, further fueling the growth of the market.

Application Analysis

The food segment led the food additives market in 2024 due to high demand for food additives such as baker's and confectionery, the beverage industry, snacks, nutritional snacks, and other similar categories. High demand for convenient snacks, vegan snacks, and frozen food options further fuels the growth of the market.

The beverage segment is expected to grow in the foreseen period due to high demand for ready-to-drink beverages, fortified and organic beverages, and beverages available in eco-friendly packaging. Such packages are available in convenient packaging, which makes them easy to carry while traveling. Hence, the segment is vital for the growth of the food additives market in the foreseeable period.

Functionality Analysis

The thickening segment led the food additives market in 2024 due to high demand for convenient food options. When food options look attractive and have an improved texture, they are highly preferred by consumers. Hence, the segment has a major role in the growth of the market, further fueling its expansion. High demand for plant-based stabilizers helps avoid the use of additional chemicals, which also fuels market growth.

The stabilizing segment is expected to grow during the forecast period due to high demand for natural and healthier alternatives by health-conscious consumers. Stabilizers made from natural ingredients further fuel the product innovation, also helping the growth of the market. High demand for vegan food options and dairy alternatives also aids the growth of the food additives market in the foreseeable period.

Value Chain Analysis for Food Additives Market

1. Raw Material Procurement

Food additive manufacturers source a mix of chemical, biological, and natural feedstocks, including petrochemical derivatives, plant extracts, fermentation cultures, and minerals. Supply reliability and purity are key, as even minor contamination affects safety and functionality. Increasing demand for “clean label” and natural additives (e.g., beet-derived colors, enzyme-based preservatives) shifts sourcing toward agricultural and biotech inputs. Volatile raw material prices, import dependence, and sustainability compliance add procurement risk and cost.

2. Processing and Formulation

Value is created through chemical synthesis, fermentation, extraction, and blending processes that produce functional ingredients like emulsifiers, stabilizers, flavors, and preservatives. This stage requires high R&D intensity, with focus on efficiency, sensory performance, and regulatory-compliant formulations. Automation and precision control ensure consistency in potency and dispersibility. Manufacturers often operate in a B2B model, supplying bulk or customized formulations to food producers, where product differentiation and IP protection drive margins.

3. Quality Testing and Certification

Quality assurance is stringent due to food safety regulations (e.g., FSSAI, EFSA, and FDA standards). Additives undergo microbiological, chemical, and sensory testing to ensure compliance with purity and functional claims. Certification (ISO, HACCP, Halal, Kosher, organic) is critical for global market access and brand credibility. Continuous monitoring and traceability systems help maintain trust with food manufacturers, but raise operational costs — especially for smaller firms targeting export markets.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Food Robotics Market: The global food robotics market size is forecasted to reach from USD 2.81 billion in 2025 to USD 15.29 billion by 2034, expanding at a CAGR of 20.7% during the forecast period from 2025 to 2034.

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Personalized Nutrition Market: The global personalized nutrition market size is forecasted to expand from USD 17.92 billion in 2025 to USD 61.56 billion by 2034, growing at a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

- Frozen Meat Market: The global frozen meat market size is expected to grow from USD 97.58 billion in 2025 to USD 129.56 billion by 2034, at a CAGR of 3.2% over the forecast period from 2025 to 2034.

Top Companies in the Food Additives Market and Their Strategic Impact

- Cargill, Incorporated: A global leader in food ingredients and agricultural solutions, Cargill produces sweeteners, texturizers, and functional ingredients focused on clean-label and plant-based innovation.

- BASF SE: Develops a wide range of food-grade vitamins, emulsifiers, and nutritional ingredients, emphasizing sustainable production and fortification solutions for health-focused foods.

- ADM (Archer Daniels Midland Company): One of the largest food ingredient producers, ADM specializes in plant-based proteins, natural flavors, emulsifiers, and specialty oils supporting nutrition and wellness.

- IFF (International Flavors & Fragrances Inc.): Provides flavors, fragrances, and functional ingredients through its integrated food and beverage solutions platform, focusing on sensory enhancement and natural flavor innovation.

- Kerry Group plc: A global taste and nutrition company offering functional food ingredients, flavor systems, and clean-label solutions for beverages, dairy, and plant-based products.

- Ingredion Incorporated: Specializes in starches, sweeteners, and texturizing ingredients derived from natural sources, serving industries focused on nutrition, sustainability, and functionality.

- Tate & Lyle: Produces specialty food ingredients such as fibers, sweeteners, and stabilizers, with a strong emphasis on sugar reduction and digestive health innovation.

- Novozymes: A global biotechnology leader focused on enzyme-based food processing solutions that enhance efficiency, texture, and flavor while reducing waste and energy use.

- Ashland: Provides specialty food and beverage ingredients, including hydrocolloids and stabilizers, supporting texture and formulation optimization for processed foods.

- CP Kelco: A leading producer of pectin, xanthan gum, and gellan gum, offering sustainable hydrocolloid solutions that improve stability and texture in beverages and dairy products.

- Glanbia PLC: Operates in the nutrition sector, producing whey protein, performance nutrition products, and functional dairy ingredients for health and sports markets.

- Sensient Technologies Corporation: Manufactures natural colors, flavors, and extracts for food and beverage applications, focusing on clean-label and plant-derived ingredient innovation.

- Corbion: Specializes in lactic acid and its derivatives, producing natural preservatives, emulsifiers, and functional blends for bakery, meat, and beverage applications.

- Foodchem International Corporation: A major Chinese supplier of food additives and nutritional ingredients, offering a wide portfolio including sweeteners, flavor enhancers, and thickeners.

- Amano Enzyme Inc.: Develops enzymatic solutions for flavor enhancement, protein hydrolysis, and texture improvement, catering to food, beverage, and nutraceutical industries.

- Enzyme Supplies: Focuses on industrial enzyme formulations for food processing, improving texture, flavor release, and production efficiency in bakery and beverage applications.

- ACE Ingredients Co., Ltd.: Produces amino acids, flavor enhancers, and functional food ingredients, emphasizing R&D for umami taste and nutritional fortification.

- FDL Ltd: Offers customized flavor systems and natural extracts for global food manufacturers, focusing on sensory innovation and clean-label development.

- Nexira: A leading supplier of natural ingredients such as acacia gum, fibers, and botanical extracts, promoting digestive health and functional food applications.

- Bell Flavors & Fragrances: Provides flavor and fragrance solutions for food and beverages, focusing on natural and sustainable flavor creation for global consumer brands.

Segments Covered in the Report

By Type

- Emulsifiers

- Hydrocolloids

- Preservatives

- Enzymes

- Flavors

- Anti-caking Agents

- Colors

- Sugar Substitutes

- Dietary Fibers

- Vitamin & Mineral Premixes

- Acidulants

By Source

- Natural

- Synthetic

By Form

- Dry

- Liquid

By Application

- Food

- Dairy & Non-Dairy Products

- Bakery & Confectionery Products

- Supplements & Sports Nutrition

- Meat & Seafood and Meat Alternative Products

- Cereal, Savory, & Snacks

- Soups, Sauces, Dressing & Condiments

- Other Food Applications

- Beverages

- Alcoholic Drinks

- Juice & Juice Concentrates

- Functional Drinks

- Carbonated Soft Drinks

- Powdered Drinks

- Other Beverages

By Functionality (Qualitative)

- Thickening

- Stabilizing

- Binding

- Emulsifying

- Other Functionalities

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5494

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Organic Food Market: https://www.towardsfnb.com/insights/organic-food-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.